Published

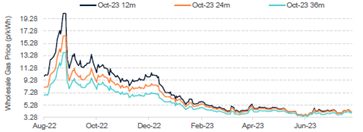

The latest market update from CPC energy consultant, Dukefield Energy (as of 4th August) highlights a fall in gas and energy prices - offering opportunity in the realm of contract renewal.

Recently, gas and electricity prices have fallen to the lowest level we have seen in the last 18 months as demonstrated in the graphs below.

Customers with contracts up for renewal between now and April 2024 would be strongly advised to look at arranging renewal contracts.

With the start of the winter on the horizon prices may start to increase again and by contracting now will protect yourselves against any rises in the market.

A sudden surge of contracts being signed in September/October could see added pressure to the markets which will increase prices.

The team at Dukefield Energy have contracted a number of customers this week producing large savings on their current contracts.

Please get in touch where Dukefield can help and support.

Market drivers - gas

Falling

- The UK government has granted over 100 new gas exploration licenses, which should help improve UK continental shelf gas supply and provide downside to later-dated seasonal gas contracts.

- The UK has already secured three LNG vessels for August and is currently bidding on a few other vessels, signifying that an uptick in LNG imports is likely going into August.

Rising

- Some minor Norwegian maintenance is scheduled for next week, but the major maintenance is set to begin toward the end of August, which may provide some upward market pressure on a short-term reduction in supply.

- Asian demand for LNG continues to rise, which could lead to greater competition for supplies over the winter and possibly provide some upward pressure.

Market drivers - electricity

Falling

- The UK and much of Europe have now entered the summer holidays, which may lead to a drop in power demand, therefore applying some downward pressure to the markets.

- Octopus Energy are set to invest $20bn into offshore wind generation, with much of the funds being focused on the UK, which should increase total UK wind generation capacity and therefore provide downside toward the end of the decade.

Rising

- Many UK businesses are yet to sign their October contract renewals and fix their remaining W23 exposure, which could lead to a sudden surge in buying pressure over the next two months.

- Southern Europe continues to be affected by the summer heatwave, which is leading to a substantial increase power-for-cooling demand.

Related News

Data Centre Equipment & Infrastructure framework arrives

Expanding CPC's selection of ICT & Telecoms purchasing agreements, NEUPC's Data Centre Equipment & Infrastructure framework is ready to utilise.

Read moreCPC awarded UK’s Best Workplaces™ recognition!

CPC has officially been named one of the UK’s Best Workplaces™ 2024 by Great Place To Work®, the global authority on workplace culture.

Read moreInvitation to Tender for Security Services framework

The Invitation to Tender (ITT) for our new Security Staffing and Associated framework has been published on MultiQuote (project ref CA13538).

Read more